【埼玉】メンズ髭ヒゲ脱毛/永久脱毛エステサロンクリニック体験おすすめ人気ランキング!口コミ評判

髭脱毛は、男性の美容において最も注目されているトレンドの一つです。

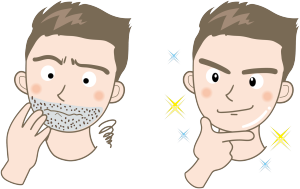

不要な髭を除去することで、清潔で若々しい印象を与えることができます。しかし、手軽なカミソリやシェーバーでの処理だけでは、肌トラブルや髭の成長を促す原因となることがあります。そこで、本格的な髭脱毛を考える男性も増えてきています。

髭脱毛の魅力は、美容だけでなく生活の質の向上にもつながります。

例えば、毎朝のシェービングをする時間を短縮することができ、忙しい朝でも余裕を持って出勤することができます。また、髭が濃い人や、肌トラブルを抱えている人は、髭脱毛によって肌トラブルの軽減や、自信の向上につながることが期待できます。

埼玉には髭脱毛を受けられるクリニックが多数あります。

埼玉は、都心からもアクセスが良く、治安も良好なため、多くの人に愛されるエリアです。また、髭脱毛に必要な機器や技術も進化しており、安全性・効果性にも配慮したクリニックが多数存在します。

埼玉には見どころがたくさんあります。

例えば、歴史的な建造物が残る「川越」や、自然豊かな「秩父」など、多彩な観光スポットがあります。また、グルメも充実しており、埼玉らしい郷土料理や、全国的に有名なラーメン店も多数あります。

男性の美容に関心のある方は、埼玉での髭脱毛を検討することをおすすめします。

魅力的な効果と、充実したクリニックのラインナップ、そして魅力的な観光地とグルメがあなたを待っています。

ぜひ、当サイトでご紹介している埼玉の髭脱毛クリニックをご検討されてみてください。

埼玉で髭脱毛おすすめ人気ランキング最新版【PR】